Cryptocurrency, or in more general terms, Decentralized Finance (DeFi-Decentralized Finance) has taken its place on the agenda as a reality that has attracted attention in terms of today’s international relations, especially in the last decade. The crypto market, which has been analyzed from many aspects since the day it entered our lives, has recently started to be analyzed with its impact on the international system.

It is generally believed that in times of war and conflict, gold and precious commodities in particular gain in value. In migration situations, it is also widely believed that relatively lightweight precious jewelry, such as jewelry and gold jewelry, are among the first items to be carried. However, it is not easy to carry large amounts of gold, and in this context, the fact that new electronic and cryptocurrency technologies can be used in many parts of the world and kept in a virtual environment is a significant advantage in conflict situations.

Recent cracks in the global system have raised new questions and issues. In this process, the role of cryptocurrencies in the war between Russia and Ukraine has been questioned. As the duration of the war increased, these questions changed or deepened. At the beginning of the war in 2022, the general question was “What will be the impact of the war on the crypto market?”; today, it is discussed what the impact of crypto on the war is.

Why Cryptocurrency?

It can be said that two main factors play a role in the increasing demand for cryptocurrencies by actors of many different statuses. The first is ease of transaction. Especially in times of crisis, it can be very difficult to process printed banknotes. It may also be impossible to withdraw money and convert it into a different currency. On the other hand, carrying cash in crisis areas can pose security problems. Therefore, using cryptos saves time and offers a relatively safer alternative. Another very important reason why cryptos are preferred is that they are unregulated. This allows for circumvention of the centralized and regulated market. It is mainly for these reasons that countries, businesses and ordinary citizens are turning to cryptos. This trend reaches much higher levels in countries that are the target of sanctions and/or are located in conflict zones.

The war launched by Russia against Ukraine in February 2022 has deeply affected the global economy in many ways. As a matter of fact, the crypto market has also been affected. As the war began, many people wondered how the war would affect the crypto market. Of course, as with other economic issues, such conflicts with a global impact caused an initial contraction in the crypto market. In the period following the start of the war, short-term data revealed a negative correlation between Bitcoin and the Russian-Ukrainian War. There are many different reasons for this decline at the beginning of the war. However, at this point, the chaos caused by the war and the decrease in positive predictions about the market were effective in this inverse relationship. On the other hand, as the war progressed, the direction of the questions asked and the course of the market changed.

As mentioned, the first impact of the war on the crypto market was a shock and negative. However, from the very first days, the interest of the warring countries and their societies in crypto has increased for different reasons. This increase gradually expanded the volume of the market and today cryptocurrencies have started to gain value again. As mentioned earlier, the main reason why cryptos are preferred in crisis geographies is that they are not dependent on a centralized financial structure. Of course, it would be wrong to consider this shift towards crypto from a single perspective. This decentralized financial system provides different benefits to different actors. It is important to remember that cryptocurrencies are as important for ordinary individuals as they are for governments. In addition, the fact that it is not subject to regulation does not mean that cryptocurrencies will always be misused. Therefore, the distinction between the individual’s and the state’s use of crypto should also include a categorization of the purposes for which it is used.

As is well known, physical and technological infrastructure suffers tremendous damage in conflict zones. This damage was felt in Ukraine at the outbreak of the war. Fear and panic quickly gripped the entire region. The first reaction of many civilians was to flee the country to save their lives. Of course, the need for money during this process of leaving or living in the middle of the war for those who stayed there locked the systems and created many victimizations. Therefore, cryptocurrencies have been the way out for individuals in the region. For example, Turkish students who were stranded in Ukraine at the beginning of the war bought their tickets by processing cryptocurrencies. The reason for such a method, even at a loss, is that cryptocurrencies offer an exit ticket in the midst of chaos and save time.

As the war has progressed, the use of cryptos for ordinary citizens has increased. For Ukraine, the main reason for this was the chaos the war created in the region, while for those living in Russia, it was sanctions. In International Relations, sanctions are restrictions and punishments used as an alternative to armed conflict when a state violates international law. At this point, the most important type of sanctions among these alternatives is economic sanctions. As a matter of fact, this was the first method that the West resorted to in the Ukraine War. Following the outbreak of the war, sanctions and embargo decisions were taken against Russia and continue to be taken today.

Of course, these decisions affect the targeted country and its government as well as its people. It is almost impossible for individuals in sanctioned countries to carry out what can be considered normal commercial transactions due to financial restrictions.[1] Indeed, this impossibility has driven the Russian public to crypto from the very beginning of the war. According to Reuters citing CryptoCompare, the volume of trade between the ruble and cryptocurrencies reached 15.3 billion rubles on Monday, the fifth day of the war, up threefold from last week.[2] As can be seen, citizens of sanctioned countries, concerned about economic progress and exchange rate volatility, have sought to minimize their losses in this way. However, there is also a state-level dimension to this issue that has many global implications.

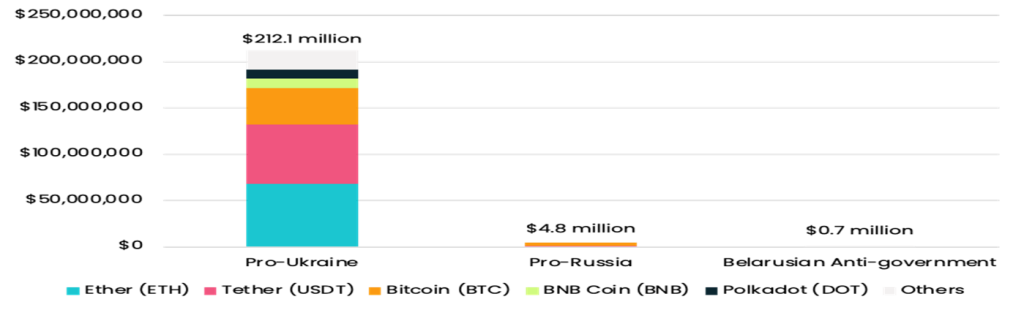

Aid is one of the most common uses of crypto by states in sanctions or conflict zones. The reason for this is, again, saving time and circumventing regulations. At this point, it should be noted that foreign aid is not only from foreign states but also directly from foreign citizens. In particular, it is seen that the Ukrainian government has earned a remarkable income in this way. As soon as the war started, Ukraine signaled that this method would be used frequently by sharing addresses for the aid expected to be made via crypto. Two days after the start of the war, the Ukrainian government shared two crypto accounts for donations on its official Twitter account.[3] Indeed, it was as expected and donations continued to increase from the very first day. Russia also received some aid in this way, but far less than Ukraine. After the end of the first year of the war, London-based Elliptic’s table shows the situation.

Table 1. Donations Received on Crypto in the First Year of the War

Source: “Crypto Donations To Ukraine And Russia: Breaking Down The Numbers”,Elliptic, https://www.elliptic.co/blog/analysis/crypto-donations-to-ukraine-and-russia-breaking-down-the-numbers, (Date Accessed: 11.03.2024).

According to Elliptic’s analysis of March 2023, in the year following the war, Russia received less than $5 million in crypto transfers, while Ukraine received over $200 million. It is also worth noting that the above analysis does not include NFTs (non-fungible tokens). When these are included, it is estimated that today, in the second year of the war, aid through the virtual market is much higher. Of course, the reason for such a high level of aid to Ukraine can be explained by the support of prosperous states, especially in the West. Even if Russia seems to be lower in this respect, it often prefers the crypto market, especially to circumvent sanctions.

As mentioned, sanctions are said to be imposed on the offending state when an international norm is undermined. While this is a subject of controversy, it also reflects a clear reality. North Korea, Iran and, more recently and with increasing severity, Russia are the leading countries targeted by sanctions. Sanctions against Russia have been particularly strong in the period following the Ukraine War. In order to overcome these sanctions, Russia has started to make significant use of the crypto market.

Sanctioned states aim to neutralize these sanctions with some strategies they pursue in the crypto market. These strategies can be summarized as cyber hacking, investment in technological infrastructure and crypto mining, creating a national cryptocurrency, creating a joint cryptocurrency with several states and promoting crypto.[4] During the war, Russia made progress in all five of these strategies, often even taking the lead.

The strategies listed above can of course be increased. However, the operations of the countries targeted by the sanctions are generally centered on these headings. Many published news reports indicate that the Russian government supports these strategies to a large extent by the state. The deepening of the sanctioned states, especially Russia, in this direction greatly expands the crypto transaction volume. There are also rumors that finance has changed direction in Palestine and Israel, another conflict zone. In the region, where crisis and chaos still continue today, interest in crypto is increasing. Both the Ukraine and the Palestinian War can be considered to be positively correlated with the recent rise.

Table 2. History of Bitcoin Prices

Source: “Price History of Bitcoin”, Investopedia, https://www.investopedia.com/articles/forex/121815/bitcoins-price-history.asp, (Date Accessed: 25.03.2024).

As a result, there seems to be a direct correlation between crises and conflicts and the increase in the value of cryptocurrencies, and this paper evaluates this relationship. Similar to gold and other precious metals and commodity markets, it is possible to observe that cryptoassets and Bitcoin generally increase in value, especially during conditions of Covid-19 pandemic or geopolitical instability such as the Ukraine-Russia War and the Gaza War. Like gold, crypto assets are also one of the tools used to bypass war and sanctions environments. Unfortunately, the lack of regulation and regulation of crypto-assets keeps the fact that these assets can be used not only for money laundering but also for the financing of terrorism and criminal organizations at the forefront.[5]

Therefore, it is possible to observe sudden outflows in crypto assets in times of panic in normal markets in times of war and emergency. Some countries, notably China, have banned cryptocurrencies and even the sale of equipment used for data mining due to this concern. Many OECD countries, including Turkey, are also in favor of regulation and stricter regulations and rules rather than bans. Therefore, it is a matter of curiosity how new crypto assets will be priced in similar geopolitical turbulent periods and instability situations after stricter regulation and regulation rules.

[1] Christoph Wronka, Digital Currencies And Economic Sanctions: The İncreasing Risk Of Sanction Evasion, Journal of Financial Crime, 29/4, 2022.

[2] Tom Wilson, Crypto exchanges won’t bar Russians, raising fears of sanctions backdoor, Reuters, 3 March 2022, https://www.reuters.com/markets/europe/crypto-exchanges-wont-bar-russians-raising-fears-sanctions-backdoor-2022-03-02/, (Date Accessed: 10.03.2024).

[3] Sümeyye Dilara Dinçer, “Ukrayna’ya Yaklaşık 17 Milyon Dolar Değerinde Kripto Para Bağışı Yapıldı”, Anadolu Ajansı, https://www.aa.com.tr/tr/ekonomi/ukrayna-ya-yaklasik-17-milyon-dolar-degerinde-kripto-para-bagisi-yapildi-/2517773, (Date Accessed: 11.03.2024).

[4] Deane R. Konowicz, The New Game: Cryptocurrency Challenges US Economic Sanctions, Naval War College Newport, 2018,p. 7-11.

[5] Ali Oğuz DİRİÖZ, “Understanding National Governments’ Desire To Regulate Crypto Currencies Through Pre-Westphalian Concepts Of Sovereignty”, Uluslararası Suçlar ve Tarih, No: 23, (September 2022), p. 141-164. https://doi.org/10.54842/ustich.1167457.